Find a professional accountant in Townsville

Fill in a short form and get free quotes from accountants in your area

Excellent rating - 4.3/5 (10900+ reviews)

Looking for an accountant in Townsville?

- Registered tax agent

- Business accountants

- Accounting and bookkeeping services

- Financial statements and annual tax return

- MYOB accounting

- … or anything else

Best rated accountants near me

Latest Review

"Chris was very committed to helping achieve my task on zero "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Pat is responsive and great to work with. Pat is very helpful and efficient. Thank you Pat "

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Best rated MYOB accountants near me

Latest Review

"Chris was very committed to helping achieve my task on zero "

Verified Badges

ID Verified

Mobile Verified

Best rated Xero accountants near me

Latest Review

"Pat is responsive and great to work with. Pat is very helpful and efficient. Thank you Pat "

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"Chris was very committed to helping achieve my task on zero "

Verified Badges

ID Verified

Mobile Verified

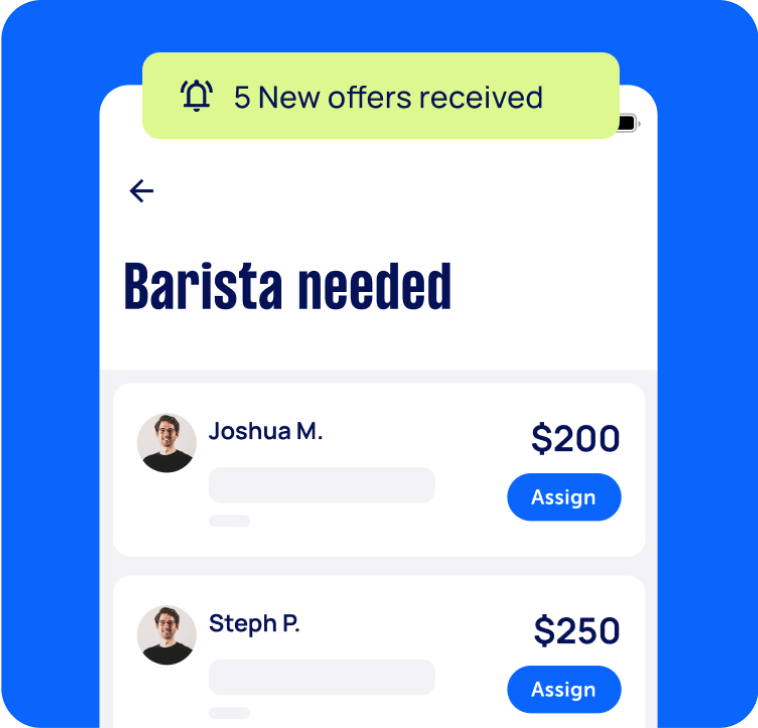

What is Airtasker?

Post your task

Tell us what you need, it's FREE to post.

Review offers

Get offers from trusted Taskers and view profiles.

Get it done

Choose the right person for your task and get it done.

- Get it done now. Pay later.

- Repay in 4 fortnightly instalments

- No interest

- Available on payments up to $1,500

Accounting Services

Related Services near me

Related Locations

Top Locations

What do accounting services include?

When booking a local accountant near you through Airtasker, you can expect the Tasker to track your cash flow, create financial reports to help you make better business decisions, analyse your business’ financial status, or even serve as a pension advisor or tax advisor.

The following is an overview of some services you might expect from your chosen accountant. The inclusions and the processes you’ll go through will depend on your personal or business situation and the services you need.

Individual tax returns with local accountants

If you want to get a personal tax accountant near you for tax returns assistance, try to book 2-3 months before the end of the financial year. This way, the tax accountant can give you pre-tax planning advice such as what to buy and write off before the financial year ends.

Once you have a tax accountant, put together your identification, a copy of last year’s notice of assessment, all your bank statements, real estate documents, claimable expense receipts, payment summaries, and other relevant files. It will take around 2 hours for the Tasker to put together your tax return - since you can ask them to go to your location, you can tick off the rest of your to-do list while waiting for them to finish.

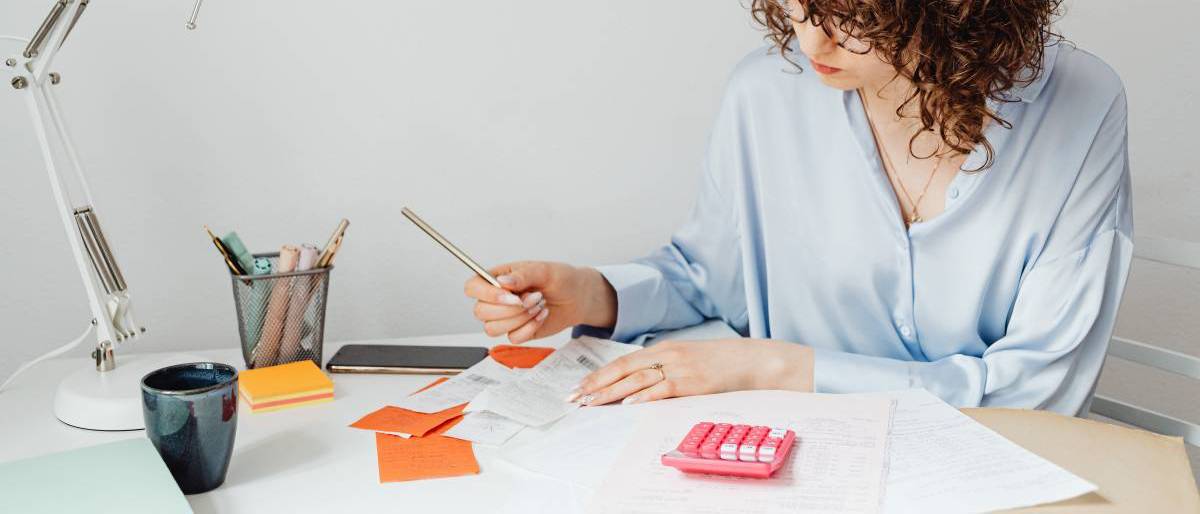

Bookkeeping and accounting

Free up your time by hiring a local independent accountant or bookkeeper near you. They can handle your financial records, saving you hours of trying to retrace every transaction! Also, you’ll get someone who’s on top of your hundreds of receipts, will manage your accounts receivable and accounts payable, and can take charge of your payroll.

If your growing business needs some extra support, you can use our platform to find trusted office administrators and experienced accountants near you for small business needs.

Budgeting and financial planning

You can easily find local accountants to help out with your budgeting needs and financial planning, whether you’re self-employed or own a small business. A Tasker can help you create a budget based on your goals, cash flow, and reports from the previous financial year. If you’re using tools like QuickBooks, the accountant can even help you optimise your use of these services.

The great thing about working with an accountant in addition to your online accounting and bookkeeping tools is that you get to learn more about what you can write off, how to better prepare for the year ahead, and how to maximise your capital.

Need an extra hand with organising receipts throughout the year? You can find a dedicated receipt organiser through Airtasker.

Business accounting

This can include business setup accounting, compliance and audits, and BAS (business activity statements) accounting. When you book a nearby accountant for your new business, they can give advice on the best financial business model to use, guide you as you fill out corporation tax paperwork, and help you set up your accounting software like Xero accounting.

For existing businesses, a Tasker can help you with the necessary financial reports and ensure that you’ve complied with all the required fees and documents that your local authorities require.

Note: The content provided has been prepared for informational purposes only. Please consult with a professional tax or financial advisor regarding your situation before making any transactions.

Recent Accounting tasks in Townsville

MYOB Help with customizing the reporting

$300

Townsville QLD, Australia

22nd Jan 2025

I require a couple of hours work and training on MYOB to sort out and input all our loans and move some costs into cost of sale on our reports.

We will be using Chris more

Tutoring in xero

$80

Townsville QLD, Australia

25th Nov 2023

Tutoring in xero bookkeeping - Due date: Flexible

Xero training small business

$50

Cranbrook QLD, Australia

30th Jun 2023

Training in Xero until confident:Data entry, Expenses/Bills to reconcile. ~using Zoom. An initial discussion for your Assessment then short sessions? But needing to start now!signed Keen Kathy - Due date: Wonderful I'd start Saturday, 1 July 2023

Bookkeeping bass lodge

$100

West End QLD, Australia

9th Nov 2022

Require to get some bass lodgements asap to order for a loan - Due date: Before Friday, November 11, 2022

Bas and income

$300

Pallarenda QLD 4810, Australia

17th Nov 2021

Activity Statements for past 12 months for my sole trading abn 2 years income tax from my job - Due date: Flexible

Recent BAS Accounting tasks in Townsville

Bas and income

$300

Pallarenda QLD 4810, Australia

17th Nov 2021

Activity Statements for past 12 months for my sole trading abn 2 years income tax from my job - Due date: Flexible

Recent MYOB Accountant tasks in Townsville

MYOB Help with customizing the reporting

$300

Townsville QLD, Australia

22nd Jan 2025

I require a couple of hours work and training on MYOB to sort out and input all our loans and move some costs into cost of sale on our reports.

We will be using Chris more

Recent XERO Accounting tasks in Townsville

Tutoring in xero

$80

Townsville QLD, Australia

25th Nov 2023

Tutoring in xero bookkeeping - Due date: Flexible

Xero training small business

$50

Cranbrook QLD, Australia

30th Jun 2023

Training in Xero until confident:Data entry, Expenses/Bills to reconcile. ~using Zoom. An initial discussion for your Assessment then short sessions? But needing to start now!signed Keen Kathy - Due date: Wonderful I'd start Saturday, 1 July 2023

Recent Bookkeeping tasks in Townsville

Bookkeeping bass lodge

$100

West End QLD, Australia

9th Nov 2022

Require to get some bass lodgements asap to order for a loan - Due date: Before Friday, November 11, 2022