Find a professional accountant in North East Melbourne

Fill in a short form and get free quotes from accountants in your area

Excellent rating - 4.3/5 (10900+ reviews)

Looking for an accountant in North East Melbourne?

- Registered tax agent

- Business accountants

- Accounting and bookkeeping services

- Financial statements and annual tax return

- MYOB accounting

- … or anything else

Best rated accountants near me

Latest Review

"excellent knowledge and assistance to keep companies book keeping compliance up to date."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Carol was super nice. Definitely recommend her !"

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Absolutely amazing! Thank you again."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Thank you Aaron for your patience and great work ethic."

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"Very nice lady , punctual and efficient "

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"Excellent at explaining "

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"Prompt, swift & overall 5 stars. Would recommend 👌 "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Very professional and communication skills was really good till the task was completed "

Verified Badges

ID Verified

Mobile Verified

Recent Accounting reviews in North East Melbourne

Thankyou Adam for processing my tax return fast even though it wasn’t straightforward. Very happy customer A++

Tax return

$80

Really happy with the service provided by Raf. He made the process easy and I will be happy to use him again.

Tax return

$300

Maple was incredible. She went above and beyond to assist on our project. Fast, responsive with a good attention to detail. She made the process easy to understand and efficient. Highly recommend.

Bookkeeping

$120

She is great Big help.

Need bookkeeping

$300

Excellent service, professional and fast as requested.

Covid Fund Grant - Tax Agent or Bas Agent

$100

All good thanks

Accounting

$300

What's the average cost of an accountant in North East Melbourne

$46 - $215

low

$46

median

$100

high

$215

Average reviews for Accounting Services in North East Melbourne

based on 38 reviews

4.97

Best rated BAS accountants near me

Latest Review

"Communication is all via email, which is great for paper tracing for both parties. Very prompt in responses, would recom..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Anthony was quick and efficient. He kept me up to date through the whole process. "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Well informed tax consultant."

Verified Badges

Mobile Verified

Twitter Verified

LinkedIn Verified

Latest Review

"Perfect person to help with the task I needed, he went above and beyond. He’s now my new tax planner and accountant. Tha..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"RAF was prompt to respond, enquire about what I needed done and offered a solution that worked for me. Happy to recommen..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Very helpful, excellent to work with knowledgeable in many areas, friendly and a lovely person. Will definitely be work..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Xianxian is very organized Accountant "

Verified Badges

ID Verified

Mobile Verified

Best rated payroll accountants near me

Latest Review

"Braden did a great job on this mystery shopper. He was very efficient."

Verified Badges

Mobile Verified

Latest Review

"Perfect person to help with the task I needed, he went above and beyond. He’s now my new tax planner and accountant. Tha..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"RAF was prompt to respond, enquire about what I needed done and offered a solution that worked for me. Happy to recommen..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Very helpful, excellent to work with knowledgeable in many areas, friendly and a lovely person. Will definitely be work..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Great advice from Mohit! Thanks so much!"

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"Vert helpful and on time. Recommended air tasker "

Verified Badges

Mobile Verified

Latest Review

"Extremely helpful for all things accounting related!"

Verified Badges

ID Verified

Mobile Verified

Best rated Xero accountants near me

Latest Review

"excellent knowledge and assistance to keep companies book keeping compliance up to date."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Excellent at explaining "

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"This is Thiru we dealt with who was knowledgeable and pleasant"

Verified Badges

Mobile Verified

Latest Review

"Very helpful, excellent to work with knowledgeable in many areas, friendly and a lovely person. Will definitely be work..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Great service and easy to communicate. Will hire him again. "

Verified Badges

Mobile Verified

Latest Review

"Vert helpful and on time. Recommended air tasker "

Verified Badges

Mobile Verified

Latest Review

"Vanessa was great to work with, highly recommend!"

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Extremely helpful for all things accounting related!"

Verified Badges

ID Verified

Mobile Verified

Recent XERO Accounting reviews in North East Melbourne

Quick responses, through with and very friendly - helped us with everything that we needed and a little more than we thought we needed.

Xero training

$1,000

Scott was great Would highly recommend

Learn Xero on more detail only know the basics

$40

Great communication. Thank you. Very Happy

Book Keeper - Xero - Construction Company

$100

Super helpful and will definitely use her services again

Setting up Xero and shiftcare for NDIS

$5

Thanks so much Jainik for helping me set up Xero. I was so nervous to set it all up as I had no idea but you explained how everything worked and set it up as required. Will definitely keep your details. Thanks again.

Xero training

$200

Thanks for your prompt work Vanessa

Xero Bookkeeping

$200

What's the average cost of a Xero accountant in North East Melbourne

$47 - $200

low

$47

median

$160

high

$200

Average reviews for XERO Accounting Services in North East Melbourne

based on 10 reviews

5

Best rated bookkeepers near me

Latest Review

"excellent knowledge and assistance to keep companies book keeping compliance up to date."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Very nice lady , punctual and efficient "

Verified Badges

ID Verified

Payment Method Verified

Mobile Verified

Latest Review

"Prompt, swift & overall 5 stars. Would recommend 👌 "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"I have no idea what it would cost to slash/spray weeds on my vacant/untended 1200sqm property so this is a statement of ..."

Verified Badges

COVID-19 Vaccination

Mobile Verified

Latest Review

"Chloe is a wonderful asset to have in all things Xero."

Verified Badges

Mobile Verified

Latest Review

"Great service and easy to communicate. Will hire him again. "

Verified Badges

Mobile Verified

Latest Review

"Vanessa was great to work with, highly recommend!"

Verified Badges

ID Verified

Mobile Verified

Latest Review

"So helpful and very lovely person. Thank you for your help! "

Verified Badges

Payment Method Verified

Mobile Verified

Recent Bookkeeping reviews in North East Melbourne

Maple was incredible. She went above and beyond to assist on our project. Fast, responsive with a good attention to detail. She made the process easy to understand and efficient. Highly recommend.

Bookkeeping

$120

Great communication. Thank you. Very Happy

Book Keeper - Xero - Construction Company

$100

An absolute godsend! Cant fault anything! Thank you so much!

Admin/bookkeeper help with record keeping audit

$150

She is great Big help.

Need bookkeeping

$300

Thanks for your prompt work Vanessa

Xero Bookkeeping

$200

Shadi was a fantastic guy, very helpful and enthusiastic. Showed up bang on time and had a great eye for design

Tidying, Organising and bookkeeping

$140

What's the average cost of a bookkeeper in North East Melbourne

$46 - $153

low

$46

median

$82

high

$153

Average reviews for Bookkeeping Services in North East Melbourne

based on 10 reviews

5

Best rated tax accountants near me

Latest Review

"Carol was super nice. Definitely recommend her !"

Verified Badges

ID Verified

Mobile Verified

Latest Review

"excellent knowledge and assistance to keep companies book keeping compliance up to date."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Very professional and communication skills was really good till the task was completed "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Anthony was quick and efficient. He kept me up to date through the whole process. "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Prompt, swift & overall 5 stars. Would recommend 👌 "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Very satisfied with the service "

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Communication is all via email, which is great for paper tracing for both parties. Very prompt in responses, would recom..."

Verified Badges

ID Verified

Mobile Verified

Latest Review

"Joshua is very prompt and no questions were too difficult. Looking forward to doing business. Thanks Joshua "

Verified Badges

COVID-19 Vaccination

ID Verified

Mobile Verified

Recent Tax Accountants reviews in North East Melbourne

Excellent service, professional and fast as requested.

Covid Fund Grant - Tax Agent or Bas Agent

$100

Quick, assertive and easy to work with. Thank you

Tax needed finalised

$50

Thank you to Edy and Line. Very thorough, quick reply’s and super helpful with our tax return. Definitely recommend and look forward to working together in the future!

Accountant company income tax

$300

Thankyou Adam for processing my tax return fast even though it wasn’t straightforward. Very happy customer A++

Tax return

$80

Really happy with the service provided by Raf. He made the process easy and I will be happy to use him again.

Tax return

$300

He is a kind person and he always ready to answer your questions

Teach me how I can do my TAX stuff

$5

What's the average cost of a tax accountant in North East Melbourne

$30 - $220

low

$30

median

$100

high

$220

Average reviews for Tax Accountants Services in North East Melbourne

based on 15 reviews

4.93

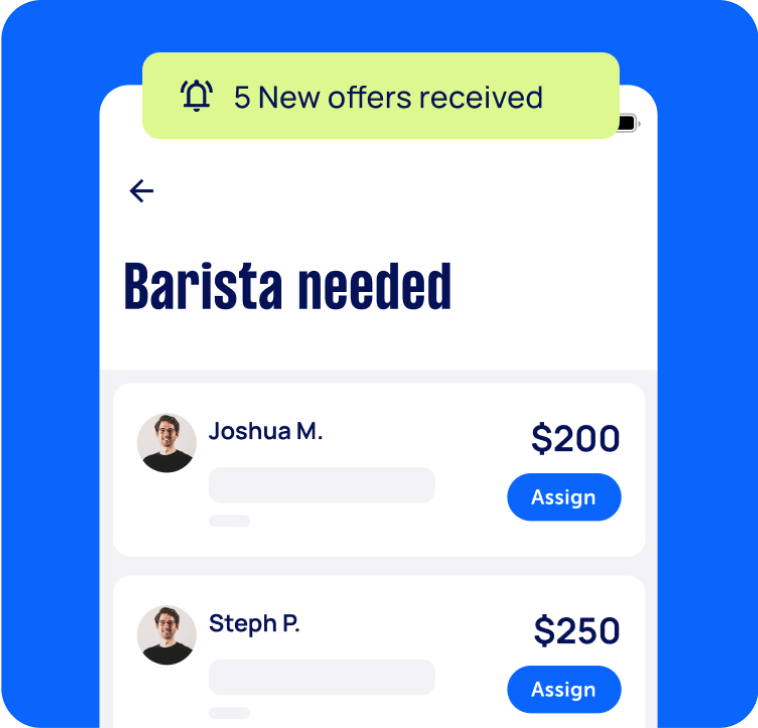

What is Airtasker?

Post your task

Tell us what you need, it's FREE to post.

Review offers

Get offers from trusted Taskers and view profiles.

Get it done

Choose the right person for your task and get it done.

- Get it done now. Pay later.

- Repay in 4 fortnightly instalments

- No interest

- Available on payments up to $1,500

46+

Tasks successfully completed

4

Average amount of offers per task

8

mins

Average time to receive offers

Statistics from the most recent tasks on Airtasker over the last 4 years.

Related Services near me

Related Locations

Top Locations

What do accounting services include?

When booking a local accountant near you through Airtasker, you can expect the Tasker to track your cash flow, create financial reports to help you make better business decisions, analyse your business’ financial status, or even serve as a pension advisor or tax advisor.

The following is an overview of some services you might expect from your chosen accountant. The inclusions and the processes you’ll go through will depend on your personal or business situation and the services you need.

Individual tax returns with local accountants

If you want to get a personal tax accountant near you for tax returns assistance, try to book 2-3 months before the end of the financial year. This way, the tax accountant can give you pre-tax planning advice such as what to buy and write off before the financial year ends.

Once you have a tax accountant, put together your identification, a copy of last year’s notice of assessment, all your bank statements, real estate documents, claimable expense receipts, payment summaries, and other relevant files. It will take around 2 hours for the Tasker to put together your tax return - since you can ask them to go to your location, you can tick off the rest of your to-do list while waiting for them to finish.

Bookkeeping and accounting

Free up your time by hiring a local independent accountant or bookkeeper near you. They can handle your financial records, saving you hours of trying to retrace every transaction! Also, you’ll get someone who’s on top of your hundreds of receipts, will manage your accounts receivable and accounts payable, and can take charge of your payroll.

If your growing business needs some extra support, you can use our platform to find trusted office administrators and experienced accountants near you for small business needs.

Budgeting and financial planning

You can easily find local accountants to help out with your budgeting needs and financial planning, whether you’re self-employed or own a small business. A Tasker can help you create a budget based on your goals, cash flow, and reports from the previous financial year. If you’re using tools like QuickBooks, the accountant can even help you optimise your use of these services.

The great thing about working with an accountant in addition to your online accounting and bookkeeping tools is that you get to learn more about what you can write off, how to better prepare for the year ahead, and how to maximise your capital.

Need an extra hand with organising receipts throughout the year? You can find a dedicated receipt organiser through Airtasker.

Business accounting

This can include business setup accounting, compliance and audits, and BAS (business activity statements) accounting. When you book a nearby accountant for your new business, they can give advice on the best financial business model to use, guide you as you fill out corporation tax paperwork, and help you set up your accounting software like Xero accounting.

For existing businesses, a Tasker can help you with the necessary financial reports and ensure that you’ve complied with all the required fees and documents that your local authorities require.

Note: The content provided has been prepared for informational purposes only. Please consult with a professional tax or financial advisor regarding your situation before making any transactions.

Recent Accounting tasks in North East Melbourne

Fast and accurate data entry A Bookkeeper

$119

Thomastown VIC 3074, Australia

9th Jul 2025

The data entry FOR WHOLE A YEAR and must fast and accuracy skill and need knowledge MYOB standard software and can work on site and the person have to sign Protecting privacy form and agree all paper do not disclose to any another.

Bookkeeper

$50

Reservoir VIC 3073, Australia

8th Jul 2025

I need someone to upload all invoices we have received (outgoings) onto Xero for me My scanner is not working so you will need to come and pick up the physical copies Then to tidy up Xero in preparation for the new financial year as I’d like to have Xero more organised to create a better flow this year. Looking for someone to also train me in using Xero after the tidy up and uploading is done

Part-Time Bookkeeper / Accounts Person

$250

Preston VIC, Australia

13th May 2025

📢 We're Hiring – Part-Time Bookkeeper / Accounts Person 📍 Onsite in Preston, VIC | 🕔 5 Hours Per Week (Permanent Role) Every Bit Organic Raw is seeking a reliable and detail-focused Bookkeeper / Accounts All-Rounder to join our team for a permanent part-time role (5 hours per week). This onsite position is based at our Preston office. Key responsibilities include: ✔️ Invoicing, reconciliations, and general bookkeeping ✔️ Payroll and BAS preparation ✔️ Maintaining accurate financial records using MYOB or Xero What we’re looking for: ✅ Proven experience in bookkeeping/accounts ✅ Ability to work independently with minimal supervision ✅ Strong attention to detail ✅ A passion for natural and organic products is a bonus! Perfect for someone looking for stable, flexible work in a friendly and purpose-driven team environment. 🌱 #PrestonJobs #PartTimeWork #Bookkeeping #AccountingJobs #EveryBitOrganicRaw #MelbourneJobs #OrganicBusiness

Book keeper

$50

Reservoir VIC, Australia

11th Apr 2025

We need a bookkeeper who is willing to come to reservoir and pick up PHYSICAL invoices and receipts. The rest of the bookkeeping can be done remotely. Need Xero to be cleaned up, fixed and updated for the last financial year and all our supplier invoices to be uploaded onto the system. I will also have emailed invoices that I will send to you to upload onto the system. Once it is up to date, I need some guidance on how to manage Xero with this. Then monthly check ins moving forward ensuring everything is updated

Book Keeping - few hours a week - Xero software

$50

Preston VIC, Australia

25th Mar 2025

Record and track a business's financial activities, such as purchases, expenses, sales, invoices, and payments. Invoicing for Accounts Receivable & Accounts Payable Reconcile bank statements with Xero

excellent knowledge and assistance to keep companies book keeping compliance up to date.

Book keeper for Splitwise

$40

Briar Hill VIC, Australia

9th Mar 2025

We need to get my wife’s Splitwise account up to date. After someone who can enter bank transactions, Medicare claims history, etc into a spreadsheet to reconcile against the list my wife’s ex husband has provided. Perfect task for a book keeper or accounting student to supervise an AI dragging in all the data from PDFs and sorting and cross referencing to the exiting list. I’d like someone nearby, as I want a face to face conversation first with the right person. $40 per hour.

Looking for account for tax purposes

$250

Ivanhoe VIC, Australia

5th Mar 2025

Hi, Getting in touch for investment tax / personal tax services accountant. Look forward to hear from you. Cheers, Shane

Company tax return

$5

Lalor VIC, Australia

1st Mar 2025

I’m looking for a professional to help with my company’s tax return. It’s a small business with no GST registration.

Carol was super nice. Definitely recommend her !

Taxes / book keeping for my small plumbing business

$100

Reservoir VIC 3073, Australia

23rd Feb 2025

I need to get on top of my taxes and book keeping I believe I am behind and might be penalised by the ATO , I owe a few BAS statements , this will Be ongoing for the right person , if you are not experienced in what i have listed , Do not apply or message me. We can agree on a price when we chat !

Updating XERO software and data entry of invoices into XERO

$200

Reservoir VIC 3073, Australia

22nd Feb 2025

Need a bookkeeper to help with small business. We have XERO software and it is all over the place, need this financial year fixed up, upload invoices that we have received onto the system and reconcile credit card. Also once completed show me quick and easy ways to do so. Meet in person, and we will provide you with all invoices etc and instructions and then you can do the work from home. won't be longer than a few hours work.

Xero training

$500

Watsonia North VIC, Australia

17th Feb 2025

Xero accounting software training

Local accountant needed for small business

$10

South Morang, Victoria

15th Feb 2025

I own a start up ecommerce business, we have containers coming and things are moving quickly, I need a local accountant who can work with me.

Absolutely amazing! Thank you again.

I need a cheap and best bookkeeper

$100

Reservoir VIC, Australia

26th Jan 2025

I am looking for cheap and best bookkiper

Bookkeeper to help with Xero

$40

Doreen VIC 3754, Australia

21st Jan 2025

Reports Account Codes GST Fix up some transactions for the Oct - Dec Bas to be lodged $40 per hour 2/3 hours

Need a financial advisor or someone with portfolio experience.

$250

Mill Park, Victoria

11th Jan 2025

I need help condensing my stock portfolio. Already have all key metrics written down have around 29 stocks on total. Looking for a financial advisor or someone experienced with managing a portfolio of Index funds, etfs, stocks reits. Need someone who fully understands fundamental analysis and can help me decide which stocks to keep and why.

Aaron was great to work with he consistently showed great insights into my portfolio and making me more confident in my trading strategy.

Bookkeeper

$5

Heidelberg VIC, Australia

17th Dec 2024

Need somebody fit ongoing bookkeeping work. Invoicing clients, preparing documents for bass and tax, following up on unpaid invoices etc. Must have experience and be doing it as a sole trader or have a business who does it

Bookkeeper

$200

Doreen VIC, Australia

25th Nov 2024

Need bookkeeper to come to home office one/two days a week to maintain xero software.

Tax calculations for me & my wife

$300

Bundoora VIC, Australia

18th Nov 2024

Individual tax calculations for me & my wife. I have a tax account and sole trader account, need to be done. Only last year. My wife has sole trader account only, not hard just simple tax calculations.

Bookkeeping

$5

Bundoora VIC 3083, Australia

23rd Oct 2024

Bookkeeping services required by our clients as and when needed.

Tax return guidance for 2 individuals

$100

Epping VIC, Australia

18th Oct 2024

Needing tax help guidance to explain ato calculations before lodging, for husband and wife living in same house.

Recent BAS Accounting tasks in North East Melbourne

BAS, personal tax, close SMSF super fund

$5

Preston VIC, Australia

7th Mar 2022

BAS is very behind on my small business. Data in Quickbooks is up to date. Close my SMSF and transfer funds to my new Australian Super. Do my personal tax returns for past 2 years. No idea what this will actually cost - tell me your rates. Liaise with ATO to reduce fines. - Due date: Before Friday, 1 April 2022

Covid Fund Grant - Tax Agent or Bas Agent

$100

Epping VIC, Australia

16th Aug 2021

I need a certified tax agent for the small business Covid grant. I qualify for the grant I need an accountant to sign my form.

Excellent service, professional and fast as requested.

Recent MYOB Accountant tasks in North East Melbourne

MYOB and Cashflow Manager Support

$100

Bundoora VIC, Australia

7th Oct 2023

Needing a savvy MYOB and Cashflow Manager person to assist in getting Cashflow manager wages transferred to MYOB, getting MYOB to talk to the ATO, getting MYOB to talk to my bank, to sort out payroll, sorting out the general ledger, and basically other bits and pieces that will stop me from rocking in a corner and crying. All of this needs to be explained in super plain English. - Due date: Needs to be done on Monday, 16 October 2023

Myob book keeping

$50

Bellfield VIC 3081, Australia

8th Apr 2023

monthly book keeping in MYOB standard for small business, approximately 80-100 lines per month - Due date: Flexible

Accounting tutorial (AO MYOB)

$200

Preston VIC 3072, Australia

24th Feb 2023

I want to boost my performance at work - Due date: Needs to be done on Saturday, 25 February 2023

MYOB Trainer and IT Support

$2,000

Epping VIC, Australia

28th Jul 2022

We require face-to-face group training to our MYOB Account Right platform. We also, require troubleshooting towards permission levels and user access issues. Additional, we need to streamline multiple files and those login-requirements and general platform techniques a go-to individual who is able to service our business face-to-face. - Due date: Needs to be done on Friday, 5 August 2022

I need to be taught how to use MYOB

$50

Thomastown VIC 3074, Australia

9th Sep 2021

Im new to MYOB and need help with familiarizing myself. I have tried to create a customised template, saved it and now i cant find it. A quote that we have created it showing the text over 2 pages and i would like to see this information on 1 page. We need to make purchase orders and just need to be shown some basics.

Need help with MYOB exercise

$50

Reservoir VIC, Australia

7th Aug 2021

I need help with myob exercise and with the opening balance and how to apply that on myob, balance sheet etc I’m flexible about the time weekends or weekdays

Recent Payroll Accountant tasks in North East Melbourne

Xero bookkeeper and payroll urgent

$200

Preston VIC, Australia

20th Jul 2022

Books for a year small business, accountant gone missing! Payroll books etc - Due date: Needs to be done on Thursday, 21 July 2022

Payroll training

$300

Wallan VIC, Australia

15th Dec 2021

New to xero payroll have experience in myob need to b able to do ato linked payroll - Due date: Before Saturday, 18th Dec 2021

Learn payroll & reconciliation on Xero

$300

Wallan VIC, Australia

10th Dec 2021

Have done 20-years myob so need to familiarize myself with xero accounting to help out business friend who is happy to pay for this. Thks - Due date: Flexible

Recent XERO Accounting tasks in North East Melbourne

Book Keeping - few hours a week - Xero software

$50

Preston VIC, Australia

25th Mar 2025

Record and track a business's financial activities, such as purchases, expenses, sales, invoices, and payments. Invoicing for Accounts Receivable & Accounts Payable Reconcile bank statements with Xero

excellent knowledge and assistance to keep companies book keeping compliance up to date.

Updating XERO software and data entry of invoices into XERO

$200

Reservoir VIC 3073, Australia

22nd Feb 2025

Need a bookkeeper to help with small business. We have XERO software and it is all over the place, need this financial year fixed up, upload invoices that we have received onto the system and reconcile credit card. Also once completed show me quick and easy ways to do so. Meet in person, and we will provide you with all invoices etc and instructions and then you can do the work from home. won't be longer than a few hours work.

Xero training

$500

Watsonia North VIC, Australia

17th Feb 2025

Xero accounting software training

Bookkeeper to help with Xero

$40

Doreen VIC 3754, Australia

21st Jan 2025

Reports Account Codes GST Fix up some transactions for the Oct - Dec Bas to be lodged $40 per hour 2/3 hours

Need help with Xero startup

$200

Thomastown VIC, Australia

25th Sep 2024

Bookkeeper with Extensive Xero Knowledge Wanted We are seeking an experienced and detail-oriented bookkeeper who possesses extensive knowledge of Xero accounting software. Key Responsibilities: Set up Xero for our business, including chart of accounts, bank feeds, invoicing, and any relevant integrations. Provide in-depth training on how to use Xero efficiently, tailored to our team’s needs. Handle all aspects of bookkeeping, including accounts payable/receivable, reconciliations, payroll, BAS, and financial reporting. Offer ongoing support and troubleshooting as needed to ensure the smooth operation of Xero within our business. Ideal Candidate: Proven experience working with Xero in a business setting. Strong understanding of accounting principles and financial management. Ability to customize Xero to fit the unique requirements of our business. Excellent communication skills and a patient, clear teaching style to train our team on Xero functionalities. Highly organised, detail-oriented, and proactive. If you’re a bookkeeper with a passion for Xero and enjoy helping businesses streamline their accounting processes, we’d love to hear from you!

Nadia was able to assist me.witj every query . Excellent communication skills .

Xero training

$250

Eltham VIC, Australia

24th Jun 2024

Hi We are a small accounting firm, looking for more advanced Xero training from a provider to do onsite training. Due to staff rostering we prefer Tuesdays and Wednesdays after 9.00 am.

This is Thiru we dealt with who was knowledgeable and pleasant

Need Xero training

$80

Donnybrook VIC, Australia

26th Apr 2024

need help subcontractor pay and creating payslips

Bookkeeper with Xero experience. Preston area

$30

Preston VIC, Australia

25th Mar 2024

Currently using MYOB would like to convert to Xero . Also for the correct person to assist on a daily basis almost 3-4 hours and then ongoing assistance with flexible hours .

Xero accountant

$80

Bundoora VIC, Australia

3rd Mar 2024

Expert in Xero payroll. Need to fix an employees annual leave/sick leave accrual for two years. Help with other items in Xero. Must know 100% how to adjust errors and how Xero calculates. Must be done in person as stated in "Location". Not possible to be done remotely. - Due date:

Book Keeper to prepare tax with Xero

$500

Thomastown VIC, Australia

4th Feb 2024

I need my books checked and prepared to file taxes for 22/23. We are a small business and use Xero. - Due date: Flexible

I need to learn xero program

$250

Preston VIC, Australia

25th Oct 2023

I need to learn the xero program - Due date: Flexible

Xero accountant

$80

Bundoora VIC, Australia

18th Oct 2023

Expert in Xero payroll. Need to fix am employees annual leave accrual for two years. Help with other items in Xero. Must know 100% how to adjust errors and how Xero calculates. - Due date: Flexible

Xero training

$300

Reservoir VIC 3073, Australia

27th Aug 2023

Struggling to get our heads around using XERO. Would love someone who could do some tutoring - Due date: Flexible

Xero training

$100

Watsonia VIC, Australia

25th Aug 2023

I would like to get a Xero training , around 1-2hours to get to know better to using the software. Please let me know your availability & cost. Thanks again Teha

Xero set up

$200

Thomastown VIC, Australia

27th Feb 2023

Starting up again with Xero not used for 5 years - Due date: Flexible

Xero training

$300

Smiths Gully VIC 3760, Australia

4th Feb 2023

Transitioning the pool building business from myob to xero. Need help with set up - Due date: Flexible

Xero training

$100

Watsonia North VIC 3087, Australia

14th Oct 2022

I’ve been using Xero for 3months. I need help using the software. Please let me know. Thanks - Due date: Needs to be done on Friday, 14 October 2022

Help on xero software to do BAS Tax Superannuation happy to learn

$50

Epping VIC 3076, Australia

13th Oct 2022

Setup company using Xero software used to have bookkeeper but not any more - Due date: Needs to be done on Friday, 14 October 2022

Good service quick service reliable always on

Xero trainner

$200

Doreen VIC 3754, Australia

15th Sep 2022

Xero training 1sttime user - Due date: Flexible

Book Keeper - Construction Company - Xero

$125

Plenty VIC, Australia

12th Sep 2022

Book keeper required for small construction company. Invoice management Xero Management and reconcile Once a week, you will be required to attend the office in Plenty. 10 - 3pm - Due date: Flexible

Recent Bookkeeping tasks in North East Melbourne

Fast and accurate data entry A Bookkeeper

$119

Thomastown VIC 3074, Australia

9th Jul 2025

The data entry FOR WHOLE A YEAR and must fast and accuracy skill and need knowledge MYOB standard software and can work on site and the person have to sign Protecting privacy form and agree all paper do not disclose to any another.

Bookkeeper

$50

Reservoir VIC 3073, Australia

8th Jul 2025

I need someone to upload all invoices we have received (outgoings) onto Xero for me My scanner is not working so you will need to come and pick up the physical copies Then to tidy up Xero in preparation for the new financial year as I’d like to have Xero more organised to create a better flow this year. Looking for someone to also train me in using Xero after the tidy up and uploading is done

Part-Time Bookkeeper / Accounts Person

$250

Preston VIC, Australia

13th May 2025

📢 We're Hiring – Part-Time Bookkeeper / Accounts Person 📍 Onsite in Preston, VIC | 🕔 5 Hours Per Week (Permanent Role) Every Bit Organic Raw is seeking a reliable and detail-focused Bookkeeper / Accounts All-Rounder to join our team for a permanent part-time role (5 hours per week). This onsite position is based at our Preston office. Key responsibilities include: ✔️ Invoicing, reconciliations, and general bookkeeping ✔️ Payroll and BAS preparation ✔️ Maintaining accurate financial records using MYOB or Xero What we’re looking for: ✅ Proven experience in bookkeeping/accounts ✅ Ability to work independently with minimal supervision ✅ Strong attention to detail ✅ A passion for natural and organic products is a bonus! Perfect for someone looking for stable, flexible work in a friendly and purpose-driven team environment. 🌱 #PrestonJobs #PartTimeWork #Bookkeeping #AccountingJobs #EveryBitOrganicRaw #MelbourneJobs #OrganicBusiness

Book keeper

$50

Reservoir VIC, Australia

11th Apr 2025

We need a bookkeeper who is willing to come to reservoir and pick up PHYSICAL invoices and receipts. The rest of the bookkeeping can be done remotely. Need Xero to be cleaned up, fixed and updated for the last financial year and all our supplier invoices to be uploaded onto the system. I will also have emailed invoices that I will send to you to upload onto the system. Once it is up to date, I need some guidance on how to manage Xero with this. Then monthly check ins moving forward ensuring everything is updated

Book Keeping - few hours a week - Xero software

$50

Preston VIC, Australia

25th Mar 2025

Record and track a business's financial activities, such as purchases, expenses, sales, invoices, and payments. Invoicing for Accounts Receivable & Accounts Payable Reconcile bank statements with Xero

excellent knowledge and assistance to keep companies book keeping compliance up to date.

Book keeper for Splitwise

$40

Briar Hill VIC, Australia

9th Mar 2025

We need to get my wife’s Splitwise account up to date. After someone who can enter bank transactions, Medicare claims history, etc into a spreadsheet to reconcile against the list my wife’s ex husband has provided. Perfect task for a book keeper or accounting student to supervise an AI dragging in all the data from PDFs and sorting and cross referencing to the exiting list. I’d like someone nearby, as I want a face to face conversation first with the right person. $40 per hour.

Taxes / book keeping for my small plumbing business

$100

Reservoir VIC 3073, Australia

23rd Feb 2025

I need to get on top of my taxes and book keeping I believe I am behind and might be penalised by the ATO , I owe a few BAS statements , this will Be ongoing for the right person , if you are not experienced in what i have listed , Do not apply or message me. We can agree on a price when we chat !

I need a cheap and best bookkeeper

$100

Reservoir VIC, Australia

26th Jan 2025

I am looking for cheap and best bookkiper

Bookkeeper to help with Xero

$40

Doreen VIC 3754, Australia

21st Jan 2025

Reports Account Codes GST Fix up some transactions for the Oct - Dec Bas to be lodged $40 per hour 2/3 hours

Bookkeeper

$5

Heidelberg VIC, Australia

17th Dec 2024

Need somebody fit ongoing bookkeeping work. Invoicing clients, preparing documents for bass and tax, following up on unpaid invoices etc. Must have experience and be doing it as a sole trader or have a business who does it

Bookkeeper

$200

Doreen VIC, Australia

25th Nov 2024

Need bookkeeper to come to home office one/two days a week to maintain xero software.

Bookkeeping

$5

Bundoora VIC 3083, Australia

23rd Oct 2024

Bookkeeping services required by our clients as and when needed.

Admin/bookkeeper help with record keeping audit

$150

Macleod VIC, Australia

17th Oct 2024

We are a childcare provider and would like an extra pair of hands to audit our files to ensure compliance. Needs to be a person who can work fast and thoroughly. Must have admin experience and great organisation 5hrs on Saturday

An absolute godsend! Cant fault anything! Thank you so much!

Onsite Bookkeeper

$40

Preston VIC, Australia

4th Sep 2024

We are looking for a bookkeeper with MYOB advance and Xero experience to work min 4 hours per week in house .Reconciling and running reports important.

Bookkeeping

$5

Preston VIC, Australia

10th Jul 2024

NDIS experience Doing Bookkeeping PAYG

Bookkeeper with Xero experience. Preston area

$30

Preston VIC, Australia

25th Mar 2024

Currently using MYOB would like to convert to Xero . Also for the correct person to assist on a daily basis almost 3-4 hours and then ongoing assistance with flexible hours .

Book Keeper to prepare tax with Xero

$500

Thomastown VIC, Australia

4th Feb 2024

I need my books checked and prepared to file taxes for 22/23. We are a small business and use Xero. - Due date: Flexible

Once-off personal bookkeeping - Tidying up tax paperwork and emails

$133

Thomastown VIC, Australia

1st Feb 2024

My paperwork and records are a bit frazzled and I need a hand getting my ducks in a row to take to an accountant. - Due date: Before Monday, 5 February 2024

Accountant fir bookkeeping

$150

Mill Park VIC, Australia

24th Jan 2024

Book keeping and tax retirn - Due date: Flexible

Tidying, Organising and bookkeeping

$140

Thomastown VIC, Australia

3rd Jan 2024

Hi there! Now that the new year is here, I'm looking at getting a few things in order. Need a hand with tidying up and organising - both the physical stuff laying around the place as well as various bits and pieces of life admin, mostly bookkeeping and streamlining of financial records etc. Please offer for an initial 4 hours. This task will need to be done in-person. - Due date: Flexible

Shadi was a fantastic guy, very helpful and enthusiastic. Showed up bang on time and had a great eye for design

Recent Tax Accountants tasks in North East Melbourne

Looking for account for tax purposes

$250

Ivanhoe VIC, Australia

5th Mar 2025

Hi, Getting in touch for investment tax / personal tax services accountant. Look forward to hear from you. Cheers, Shane

Company tax return

$5

Lalor VIC, Australia

1st Mar 2025

I’m looking for a professional to help with my company’s tax return. It’s a small business with no GST registration.

Carol was super nice. Definitely recommend her !

Taxes / book keeping for my small plumbing business

$100

Reservoir VIC 3073, Australia

23rd Feb 2025

I need to get on top of my taxes and book keeping I believe I am behind and might be penalised by the ATO , I owe a few BAS statements , this will Be ongoing for the right person , if you are not experienced in what i have listed , Do not apply or message me. We can agree on a price when we chat !

Tax calculations for me & my wife

$300

Bundoora VIC, Australia

18th Nov 2024

Individual tax calculations for me & my wife. I have a tax account and sole trader account, need to be done. Only last year. My wife has sole trader account only, not hard just simple tax calculations.

Tax return guidance for 2 individuals

$100

Epping VIC, Australia

18th Oct 2024

Needing tax help guidance to explain ato calculations before lodging, for husband and wife living in same house.

Help with lodging taxes

$50

Preston VIC, Australia

22nd Sep 2024

Ensure the tax lodgement is accurate

Tax return

$10

Reservoir VIC 3073, Australia

14th Sep 2024

Tax return TFN with Uber eat

Tax return

$200

Reservoir VIC, Australia

7th Jul 2024

Need professional accountant to do my tax return.

Complete my tax return

$30

Wollert VIC, Australia

1st Jul 2024

Looking for a tax agent to complete my tax return

Very professional and communication skills was really good till the task was completed

Financial advisor /tax

$200

Heidelberg VIC, Australia

19th Feb 2024

Wanting financial advice to remove some debt and make better decisions. Also needing to do my tax for last few years.

Tax return

$50

Heidelberg Heights VIC, Australia

31st Jan 2024

I need to get my 2023 tax return done asap - Due date: Flexible

Lovelin is awesome, fantastic communication and a pleasure to deal with Highly Recommended 10/10

X3 Tax Returns

$5

Epping VIC, Australia

5th Jan 2024

Hi there am needing x3 tax returns done for myself, my dad and my husband. We are located in Epping. Thank you - Due date: Flexible

Anthony has been super amazing to help Donny dads, my husbands and my tax return. Super helpful, friendly and efficient. Will be definitely using again. Thank you!

X 3 Tax Returns

$120

Epping VIC, Australia

4th Jan 2024

Hi there, My husband, dad and myself are needing out Tax returns done for year 2022-2023. We are happy to do online or in person. We are Located in Epping, VIC. If anyone has Afterpay available that would be great too!! Thank you! - Due date: Flexible

Need a good tax accountant

$150

Epping VIC, Australia

15th Aug 2023

I want to close down a company from ASIC . Tax return for company has been lodged. Just want to close it down permanently - Due date: Flexible

Looking for a someone to help me complete my tax return

$70

South Morang VIC, Australia

6th Jul 2023

Looking to maximise my tax return - Due date: Flexible

Income tax

$120

Epping VIC, Australia

3rd Jul 2023

Income tax and activity statement - Due date: Flexible

Tax return complex including child support

$100

Whittlesea VIC, Australia

4th Jun 2023

Tax return for high earring interstate truck driver with new child support factors - Due date: Flexible

Tax returns

$150

Reservoir VIC, Australia

22nd Mar 2023

Late on my 3 month tax returns I’m a sole trader Uber eats driver

Sole Trader tax

$200

Greensborough VIC, Australia

28th Feb 2023

Hi, well I think I’m in a bit of a mess with my tax. My husband and I separated in March of this year and he did all our accounts. Unfortunately I’ve found he wasn’t paying my tax or super for me. Since the separation I’ve buried my head in the sand with it all and haven’t done anything to do with my tax as I have no idea where to start. I was wondering if you could help me get this sorted or is this to big of a task? Thank you Bree

Complete two tax returns (20/21 & 21/22)

$200

Banyule VIC 3084, Australia

6th Jan 2023

I need someone who can complete tax returns for the past two years. Looking for an experienced person who is able to minimise my tax and maximise my potential return. I am a secondary school teacher, and have an investment property, so there will be some negative gearing involved. Happy to come to you, or you're welcome to come to me, in Rosanna - Due date: Flexible

Very professional. Helpful, patient, knowledgeable and clearly very experienced. Many thanks for your tremendous work. Much appreciated. 🙏🙏🙏