Find a professional accountant near you

Fill in a short form and get free quotes from experienced accountants

Get help from a local accountant

- Tax accountant

- Tax agent

- Bookkeepers near you

- Tax return accountant

- … or anything else

Recent Accounting tasks

File my personal tax return (you being a tax agent or accountant)

€160

Dublin, Dublin

28th Feb 2025

Doing my personal tax return. I have only a house rental property, that is it (I have no job nor anything else of income). We will need to ensure that you have the necessary qualifications and experience in Irish tax matters incl completing an 'Agent Link Notification' Agent TAIN form.

Tax return 2023

€200

Neworchard, Kilkenny

7th Oct 2024

I need to have my Tax return 2023

What is Airtasker?

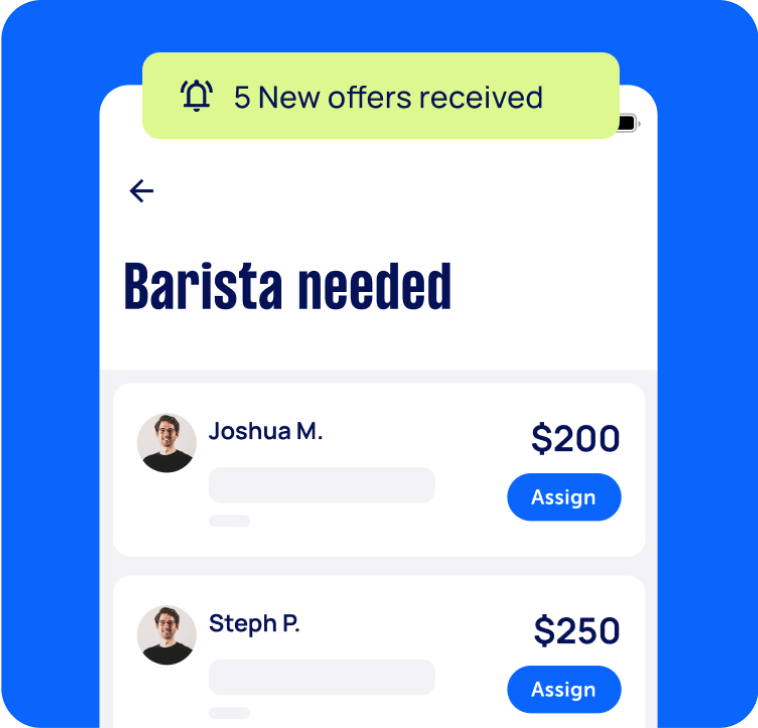

Post your task

Tell us what you need, it's FREE to post.

Review offers

Get offers from trusted Taskers and view profiles.

Get it done

Choose the right person for your task and get it done.

Why book an accountant through Airtasker?

Nothing is certain but death and taxes, and thankfully you’ll only have to concern yourself with one of those two certainties for most of your life. But why concern yourself with taxes at all?

Accounting is one of those rare services that can actually save you cash if you choose to utilise it. You spend money to make money. A good accountant near you can highlight mistakes and inefficiencies that might be costing you money on your new business, and offer ways in which you could save more money. Not only that, you’ll also save yourself an inordinate amount of time when the tax year ends, claiming the maximum amount possible to either pump up your tax refund or minimise your tax debt.

All you need to do find a quality accountant or accounting firm. And luckily they may only be a couple of clicks away! With a wealth of expert accountants now at your fingertips, hiring the perfect one in the United Kingdom has never been easier. Simply describe the taxes services that you might require, suggest a fair rate, and wait for the offers to roll in.

There’s no better time to sort your finances out than now. Get a free, no-obligation quote, and find the perfect accountant near you today.

Local, skilled pros

Take your pick of trusted Accountants near you, wherever you are in Australia.

Real reviews

Judge for yourself – every task gets a review!

Flexible pricing

Choose the offer that’s right for you!

Offers in no time

Start getting offers to do your task ASAP!

Top Accounting related questions

A good accountant should have enough experience and skills, especially in the service you require (e.g. financial management, taxes). Next, they should have a good completion rate - something you can check through the reviews on Airtasker. Lastly, they should have all the licences, insurance, and police checks needed to work as an accountant in your city, state, or country.

Yes, you can hire virtual accountants through Airtasker. To do this, post a request as you usually would, and indicate that you need someone you can work with virtually. Next, email your documents and pick a time to set up a video call. Since you may need to sign several documents that the Tasker will prepare, you may need to book a courier to pick up files.

This depends on your budget and the services you need. For those working on a budget or outsourcing their bookkeeping for the first time, a self-employed accountant is your best bet. And since Airtasker lets you dictate the budget for a service, you’re more likely to find someone within your range.

First, keep your documents in one place and make sure you have backup copies of the most critical files. Soft copies should have bank-level encryption, something an experienced IT specialist near you can set up. You can also look into setting up a direct connection with Xero (an accounting solution) and your bank. Lastly, make sure that your accountant or any finance-related personnel you hire have the necessary licences and police checks.

If you need help with financial documents, day-to-day bookkeeping, and tax forms, you need an accountant. Some accountants may also offer financial analysis and help you comply with the relevant business regulations in your area. But if you’re looking for someone to verify your financial statements and tax filing and to help you balance your books, you’ll need to hire an auditor.

To start, make sure you have all the credentials and licences needed to work as an accountant in your city, state, or country. Then, sign up as a Tasker on airtasker.com. After signing up, you’ll need to provide some verification, such as your bank details. Finally, it’s just a matter of waiting for accounting-related task posts and putting up your offer!

The cost of hiring an accountant can range from $100 to $400, depending on the type of service you need. Rates can go higher or lower based on the purpose of the consultation and other factors. Get an idea of how much to pay for an accountant and find the best Tasker that fits your budget.

Some accountants can offer financial advice and planning services to help small business owners or individuals with their finances. The rates of financial advisors can range from $100 to $400, depending on the type of financial advice you need. They can charge by the hour or by project. Find out how much to pay accountants for their financial advisory services to set the right budget when booking on our platform.

Finding an accountant near you is easier than ever, thanks to Airtasker. Simply post a task outlining your needs and receive quotes from top-rated accountants in your area.

Top Forensic Accounting related questions

A certified accountant serves as a trusted financial adviser and can help with bookkeeping, payroll, and planning. A forensic accountant, however, is specifically trained for investigative work. Forensic audit services help analyse and address issues like theft and fraud. You can hire a regular accountant to do your employee payroll. However, if you suspect that your business is suffering from money laundering, for example, then it’s best to hire a forensic accountant instead.

Commercial damages, shareholder disputes, money laundering, and embezzlement are often too politically charged and overwhelming for an in-house accounting team to handle. When you outsource forensic accounting services, they can help provide neutral ground between parties. You can also trust that your Tasker is adept at financial analysis, strong with their investigation and communication skills, and has the ability to work with legal services.

Yes, a forensic accountant can definitely help you with personal financial matters. Their services will especially be helpful if you suspect that your personal finances are being subjected to fraud or embezzlement. They can also help you file insurance claims and serve as the mediator between you and your carrier. For matters like personal bookkeeping, however, you may want to hire bookkeeping services near you instead.

When it comes to financial crimes, attorneys and forensic accountants need each other. A forensic accountant can help provide the necessary data that can serve as evidence for a particular case. A lawyer can help interpret these in the context of the law. This is why a forensic accountant is particularly relevant in litigation services, as they can prevent comprehensive reports and serve as expert witnesses.

Top Payroll Accountant related questions

Payroll outsourcing services can help save you the time and energy it takes to process payroll. For medium to small-sized businesses, outsourcing your payroll accountant can also be more cost-effective than maintaining an in-house payroll department. Moreover, most payroll accounting services nowadays feature higher security measures. This way, you can feel assured that your employees’ data and your organisation’s finances are secured and protected.

The actual payroll process involves putting input data into online payroll software. Your payroll accountant will oversee salary calculations, as well as those of other relevant taxes and deductions. Then, the payout can be provided via cash, check, or bank transfer. After the payout is complete, your accountant can provide individual reports to your employees and a separate report for your stakeholders’ review.

Airtasker makes it easy for you to hire a well-trained and experienced payroll accountant. Post your task, and Airtasker will connect you with dozens of payroll outsourcing services. You can go through customer reviews and find the Tasker that best suits you and your organisation’s needs. Thanks to Airtasker’s convenient platform, you can privately message your chosen Tasker and make arrangements with them from there.

Employers must keep time and wages records for seven years. Ensure that these records are kept in English and are clear and legible (if written). Remember that payroll records are strictly private and must be kept secure between your employees and your payroll accountant. Hiring a reliable and trustworthy accountant is vital in maintaining the security of your data.

While payroll companies and payroll specialists are trained to manage and handle finances, their services are best maximised within a business or organisational context. If you need somebody to clean up and manage your personal finances, then you can hire a professional financial planner near you. A financial planner can help you sort out your and your family’s assets and liabilities.

Top XERO Accounting related questions

It’s not that difficult to learn Xero since this software is quite intuitive. But like any new thing, there is a learning curve. Most people can master Xero in 2-3 weeks. There is also a training portal that beginners can use to understand the software better and maximise their subscriptions. No time to learn? Hire an accountant who’s well-versed in Xero, instead.

Not necessarily. While Xero can help with accounting tasks, it is mostly accountants and bookkeepers who benefit the most from this software. Since Xero helps them finish their bookkeeping and reports faster, the Tasker you hire will have more time to do things like analyse reports, give advice on how to save better, and help you steer clear of any liabilities.

Not necessarily. You can learn to set it up and use it yourself, but to maximise your Xero account (and your time), it is still highly recommended that you get an accounting expert to help you with your books. And since Xero is a tool that many accountants use, you can certainly book a Tasker to give you tips for using Xero by yourself - then simply call the Tasker in to help you during tax season.

If you need technical support with Xero, the Tasker may be able to help you. But for other technical problems, such as other software, your office computers, or your internet connection, it is best to look for a tech support expert near you. No need to do DIY fixes - book a Tasker instead!

It depends on what you and your team are looking for. Xero is great for startups, while QuickBooks can be used with growing businesses. Both offer similar features, but Xero is has a more streamlined interface and is easier to use. Xero can also connect with over 700 applications, such as your payroll, e-commerce, and time tracking software. Price-wise, QuickBooks costs a little more overall but has more flexible plans than Xero.

A Xero accountant may not be able to help with filing and documentation. Their focus is on helping you maximise your accounting software. If you need help filing documents related to your business, it’s best to hire a filing specialist near you using our platform.

Top Bookkeeping related questions

Top Tax Accountants related questions

Accounting Services

Related Services near me

What's included when you hire an accountant

The inclusions and process you’ll go through with your new accountant will depend on your situation and the type of accounting services you need.

Individual tax returns

Everybody should have a reliable tax accountant to them submit their personal tax each year. It’s usually best to contact your tax agent early on in the year - ideally 2-3 months before EOFY. Not just to make sure they can fit you in, but also to get pre-tax planning advice on what you might be able to buy and write off before the year is up.

Once you find an accountant or a suitable tax agent near you to do your tax return, book them in! This time of year things get really busy, so don’t leave it too late. Bring to your appointment your identification, a copy of last year’s notice of assessment, bank statements, real estate info, claimable expense receipts, payment summaries, and anything else that might be relevant. Usually, your local accountant will need around 1-2 hours to prepare your tax return and may do it while you’re there during the appointment, or finish it off (with your approval) later on.

Budgeting and financial planning

Your accountant can help you create a budget or in some cases, even plan your finances. You can set up an appointment to talk about your finances, goals, income, and expenses. Then your local accountant can use their tools (and years of experience) to advise you on the best steps forward. The benefit of engaging an accountant for budgeting is that they can look at your finances through the lens of what you can write off, the tax you owe, and what you might get back.

Business setup accounting

One of the first things you should do if you’re setting up a business is to engage an accountant or accounting firm that's experienced in business or corporation tax. They’ll advise you on the best business structures based on the type of business and projected income level from financial modelling. And they’ll help you feel more confident you’ve ticked the right boxes as you fill out any paperwork. Plus, your local accountant can get you set up with MYOB, Xero, or another type of accounting software.

Compliance and audits

Staying compliant is essential for businesses to avoid fines and minimise risk. But if you’re not familiar with the rules of small businesses or corporation tax, it's easy to miss a detail or take the wrong step. Your accountant can help you with the financial reports you need or help you get your ducks in a row for an audit. During your appointment, you’ll answer a lot of different questions about the type of work you do, how you record your data, and more. Your accountant will go through a checklist to make sure you’ve covered off everything you need to operate in compliance with local and federal regulations.

BAS accounting

If you’re registered for, you’ll need to submit regular business activity statements (BAS). For most businesses, it makes sense to engage a registered BAS accountant to manage and submit your BAS. BAS agents get extra time, so if you’re in a rush to submit your BAS, you can breathe a sigh of relief when you engage a professional to take care of it. To do your BAS, your accountant will need access to your bookkeeping and accounting software to track the GST you’ve paid and collected over a 3-month period. They’ll calculate the amount you owe then submit this to the HM Revenue & Customs.

Bookkeeping

Many accountants also offer bookkeeping services or can help with your regular payroll. If you’re a small business or contractor, hiring a bookkeeper makes sense because it frees you up to serve more customers or just get back some family time. Hiring a bookkeeper means you can finally hand your shoebox of receipts or hundreds of receipt emails over someone who will know what to do with it.

Because the inclusions vary so much between different accounting services, it’s always a good idea to check with your accountant before you start working together. Get the inclusions in writing, and if you need something specific to your situation, you can always let them know when you post your task here on Airtasker.