Find a professional accountant in Unsworth

Fill in a short form and get free quotes for accountancy services in your area

Excellent rating - 4.3/5 (9300+ reviews)

Get help from a local accountant

- Tax services

- Chartered accoutants

- Bookkeepers in Unsworth

- Tax return accountant

- Corporation tax

- … or anything else

Popular services in your area

What is Airtasker?

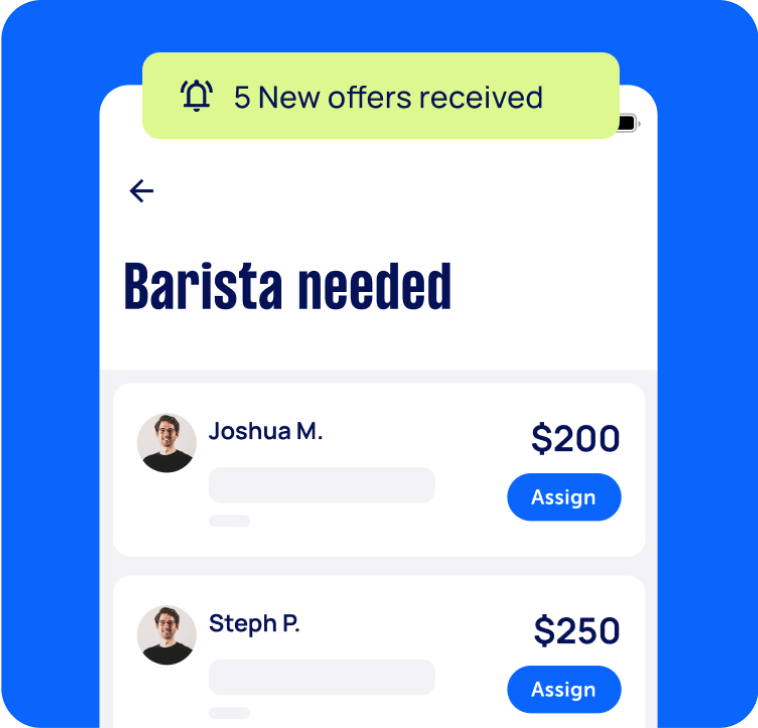

Post your task

Tell us what you need, it's FREE to post.

Review offers

Get offers from trusted Taskers and view profiles.

Get it done

Choose the right person for your task and get it done.

Accounting Services

Related Locations

East Riding of Yorkshire

Hazel Grove

Ladybarn

Stoneyfield

Altrincham

Benchill

Astley

Ashton-in-Makerfield

St. Georges

Failsworth

Greater Manchester Salford

Wigan

Longsight

Sale

Elton

Irlam

Urmston

Great Lever

Flowery Field

Swinton

Stalybridge

Lower Broughton

New Moston

Burnage

Tyldesley

West Didsbury

Blackley

Oldham

Merseyside

Timperley

Strangeways

Hyde

Didsbury

Stretford

Wingates

Fallowfield

Gatley

Reddish

Busk

Trafford Metropolitan Borough

Cheadle

Grotton

Openshaw

Broughton

Greater Manchester Middleton

Dukinfield

Old Trafford

Pendlebury

Sholver

Hurstead

Leigh

Audenshaw

Hooley Hill

Woods End

Hulme

Lydgate

Heaton Moor

Oldham Edge

Higher Blackley

Cheadle Heath

Wythenshawe

West Timperley

Moston

Whalley Range

Greater Manchester Bradford

Miles Platting

Stockport Metropolitan Borough

Heald Green

Collyhurst

Shaw

Greater Manchester Stockport

Hale

Heywood

Higher Broughton

Ashton under Lyne

Salford Quays

Chadderton

Beswick

Moss Side

Rochdale

Levenshulme

Trafford

Heaton Norris

Crumpsall

Radcliffe

Hollins

Gilnow

Abbey Hey

Northenden

Oak Bank

West Gorton

Withington

Hall I'th'Wood

Gee Cross

Brownlow Fold

Swinley

Greater Manchester

Bolton Metropolitan Borough

Bury Metropolitan Borough

Royton

North Reddish

Greater Manchester Clifton

Gorse Hill

Clayton

Baguley

Droylsden

Tameside Metropolitan Borough

Cheadle Hulme

Brooklands

Broadheath

Rochdale Metropolitan Borough

Ardwick

Ancoats

Bolton

Westhoughton

Oldham Metropolitan Borough

Flixton

Eccles

Nimble Nook

Worsley

Chorlton upon Medlock

Whitefield

Walkden

Crofts Bank

Charlestown

Weaste

Denton

Chorlton Cum Hardy

Heap Bridge

Bredbury

Greater Manchester Salford Metropolitan Borough

Rusholme

Long Sight

Harpurhey

Staffordshire

Ashton upon Mersey

East Didsbury

Cheetham Hill

Bury

Little Hulton

Prestwich

Crowhill

Bramhall

Greater Manchester Woodford

Wilmslow

Hindley

Atherton

Manchester

What's included when you hire an accountant

The inclusions and process you’ll go through with your new accountant will depend on your situation and the type of accounting services you need.

Individual tax returns

Everybody should have a reliable tax accountant to them submit their personal tax each year. It’s usually best to contact your tax agent early on in the year - ideally 2-3 months before EOFY. Not just to make sure they can fit you in, but also to get pre-tax planning advice on what you might be able to buy and write off before the year is up.

Once you find an accountant or a suitable tax agent near you to do your tax return, book them in! This time of year things get really busy, so don’t leave it too late. Bring to your appointment your identification, a copy of last year’s notice of assessment, bank statements, real estate info, claimable expense receipts, payment summaries, and anything else that might be relevant. Usually, your local accountant will need around 1-2 hours to prepare your tax return and may do it while you’re there during the appointment, or finish it off (with your approval) later on.

Budgeting and financial planning

Your accountant can help you create a budget or in some cases, even plan your finances. You can set up an appointment to talk about your finances, goals, income, and expenses. Then your local accountant can use their tools (and years of experience) to advise you on the best steps forward. The benefit of engaging an accountant for budgeting is that they can look at your finances through the lens of what you can write off, the tax you owe, and what you might get back.

Business setup accounting

One of the first things you should do if you’re setting up a business is to engage an accountant or accounting firm that's experienced in business or corporation tax. They’ll advise you on the best business structures based on the type of business and projected income level from financial modelling. And they’ll help you feel more confident you’ve ticked the right boxes as you fill out any paperwork. Plus, your local accountant can get you set up with MYOB, Xero, or another type of accounting software.

Compliance and audits

Staying compliant is essential for businesses to avoid fines and minimise risk. But if you’re not familiar with the rules of small businesses or corporation tax, it's easy to miss a detail or take the wrong step. Your accountant can help you with the financial reports you need or help you get your ducks in a row for an audit. During your appointment, you’ll answer a lot of different questions about the type of work you do, how you record your data, and more. Your accountant will go through a checklist to make sure you’ve covered off everything you need to operate in compliance with local and federal regulations.

BAS accounting

If you’re registered for, you’ll need to submit regular business activity statements (BAS). For most businesses, it makes sense to engage a registered BAS accountant to manage and submit your BAS. BAS agents get extra time, so if you’re in a rush to submit your BAS, you can breathe a sigh of relief when you engage a professional to take care of it. To do your BAS, your accountant will need access to your bookkeeping and accounting software to track the GST you’ve paid and collected over a 3-month period. They’ll calculate the amount you owe then submit this to the HM Revenue & Customs.

Bookkeeping

Many accountants also offer bookkeeping services or can help with your regular payroll. If you’re a small business or contractor, hiring a bookkeeper makes sense because it frees you up to serve more customers or just get back some family time. Hiring a bookkeeper means you can finally hand your shoebox of receipts or hundreds of receipt emails over someone who will know what to do with it.

Because the inclusions vary so much between different accounting services, it’s always a good idea to check with your accountant before you start working together. Get the inclusions in writing, and if you need something specific to your situation, you can always let them know when you post your task here on Airtasker.